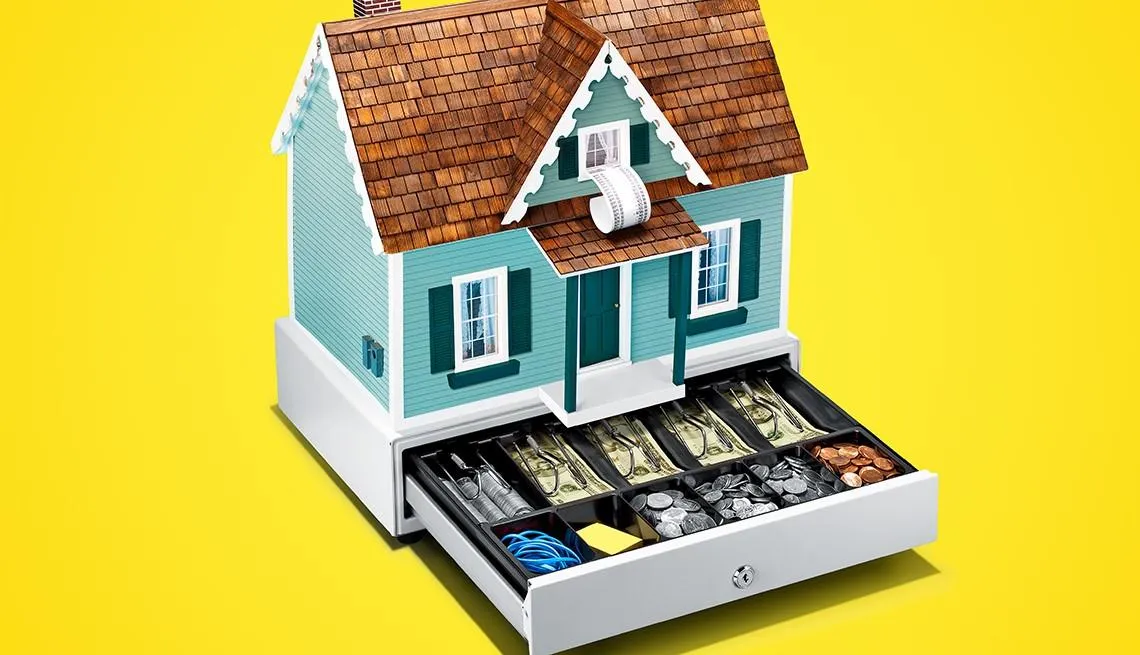

Now You Have Sold Your House - What to do With All That Cash

Navigating Retirement and tapping into Your Largest Source of Equity: Selling Your Home, Downsizing, and Smart Equity Investment

As retirement approaches, many people find themselves contemplating a significant lifestyle change: downsizing or selling their family home. For some, it's a financial necessity, while for others, it's a strategic decision to simplify their lives and free up resources for other pursuits. Whatever the reason, this transition can be both daunting and exciting. In this blog post, we'll explore the considerations involved in selling your home, downsizing, or moving to an apartment, and offer insights into how to invest the equity wisely.

The Decision to Downsize or Sell

Deciding to downsize or sell your home is a deeply personal choice that involves a multitude of factors:

1. Financial Freedom: Selling a larger home can release equity that can be used to fund retirement expenses, travel plans, or other financial goals. With the current housing market, the equity gained from selling a property can be substantial.

2. Maintenance: As we age, the upkeep of a large property can become burdensome, in both summer and winter. Downsizing to a smaller home or apartment often means less maintenance and lower utility costs, freeing up time and resources for enjoying retirement.

3. Lifestyle Changes: Many retirees find that their housing needs evolve. Children move out, and the space that was once necessary may now feel excessive. Opting for a smaller, more manageable home can align better with their current lifestyle and preferences.

4. Location Preferences: Some retirees choose to move to areas with a more favorable climate or closer to family, amenities, or preferred recreational activities. Sometimes, it involves two new locations, a vacation property in the southern US and a summer home here.

Exploring Investment Options for Equity

Once the decision to sell or downsize is made, the next step is to determine what to do with the equity released from the sale of the property. Here are some investment options that should be considered:

1. Diversified Portfolio: Many financial advisors recommend diversifying investments across asset classes such as a mix of Canadian and international stocks, Canadian and international bonds, and fixed income such as GIC’s and HISA’s. This approach can help manage risk while potentially providing steady returns, to ensure your money is growing faster than the rate of inflation.

2. Tax-Advantaged Accounts: Investing in tax-advantaged accounts such as Tax-Free Savings Accounts (TFSAs) and Registered Retirement Savings Plans (RRSPs), if age allows, can offer significant tax benefits in retirement. These accounts may provide tax-free growth or tax-deferred withdrawals, depending on the type of account, helping retirees maximize their retirement savings.

3. Insurance Strategies: Insurance companies can offer valuable strategies for protecting excess assets that can't be sheltered in TFSA and RRSP accounts. By naming beneficiaries for non-registered accounts, retirees can ensure that these assets are passed on efficiently to their loved ones while minimizing estate taxes and probate fees. This is a key piece to efficient estate planning life, that is only offered by insurance companies. Banks cannot offer named beneficiaries for your non-registered accounts. A non-registered account could be any account that doesn’t fall under the TFSA, RRSP/RRIF, LIRA/LIF umbrella, with non-registered GIC’s and HISA’s being the most common.

4. Long-Term Care Planning: As retirees age, the need for long-term care may arise. Allocating a portion of the equity towards long-term care insurance or setting aside funds for future healthcare expenses can provide peace of mind, considering Canada's healthcare system and potential healthcare costs in retirement.

5. Consulting a Financial Advisor: Every Canadian retiree's financial situation is unique, and it's essential to seek personalized advice from a qualified financial advisor familiar with Canada's tax laws and retirement landscape. A professional can help assess your goals, risk tolerance, and investment horizon to develop a tailored investment strategy that aligns with Canada's economic environment and regulatory framework.

Conclusion

Selling your home, downsizing, or moving to an apartment can mark a significant milestone in your retirement journey. It's a decision that requires careful consideration of your financial goals, lifestyle preferences, and long-term needs. By thoughtfully managing the equity released from the sale of your property and investing wisely, you can enhance your financial security and enjoy a fulfilling and comfortable retirement.

Remember, the key is to plan ahead, seek professional guidance when needed, and make informed decisions that align with your values and aspirations. Whether you're embarking on a new adventure or embracing a simpler way of life, navigating retirement with confidence and financial savvy can lead to a rewarding and fulfilling chapter ahead.