Segregated Funds vs Mutual Funds

Segregated Funds vs. Mutual Funds: Understanding Your Investment Options

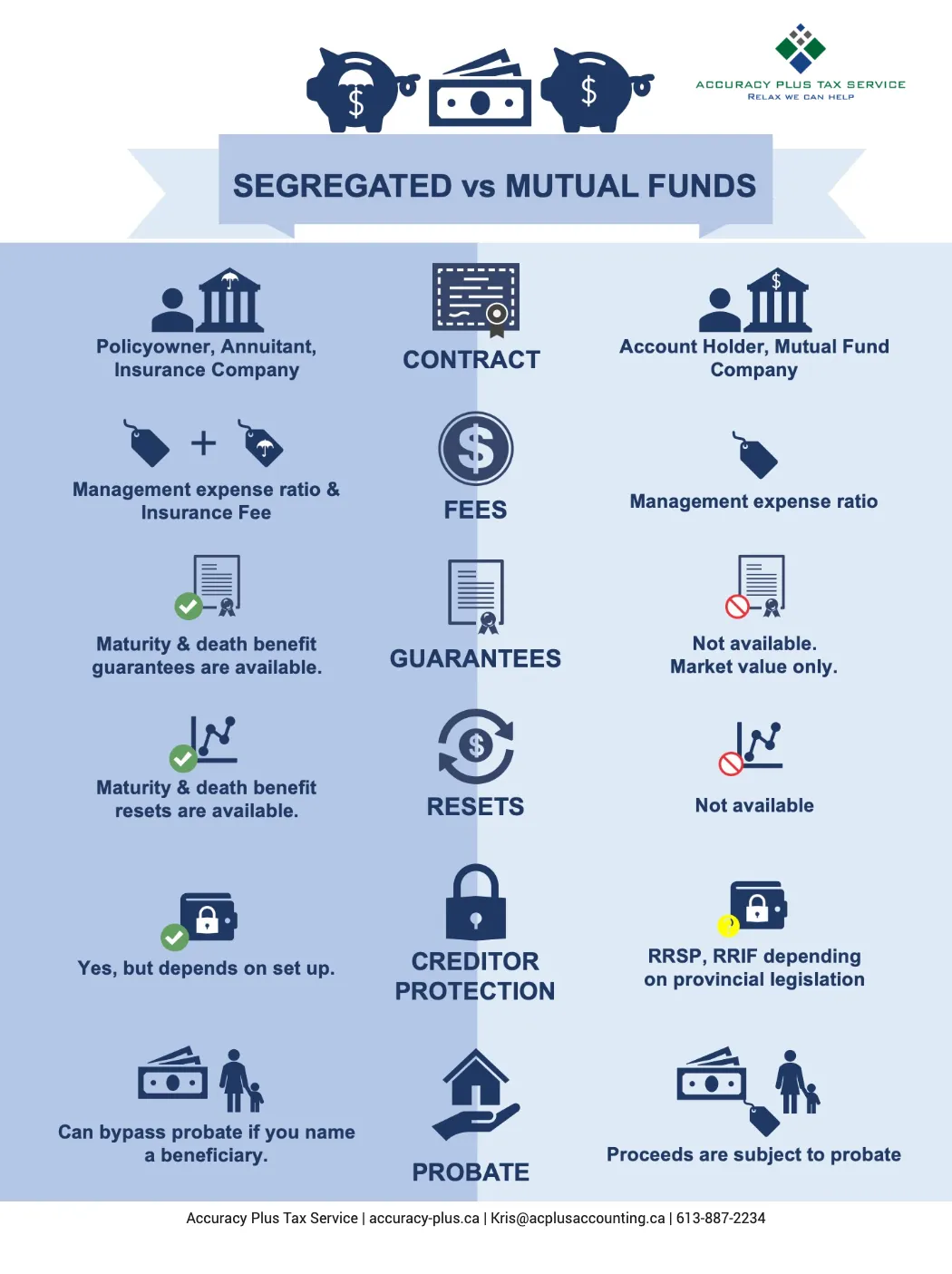

Investing can be a complex and daunting endeavor, especially when faced with the myriad of options available in the market. Two popular investment vehicles, segregated funds and mutual funds, often vie for the attention of investors seeking to grow their wealth and secure their financial future. In this article, we'll delve into the differences between segregated funds and mutual funds to help you make informed decisions about your investment strategy.

Segregated funds, also known as seg funds, are insurance products offered by life insurance companies. They combine the growth potential of investment funds with the security features of insurance products. One of the key advantages of segregated funds is their principal protection feature, which guarantees a portion of the original investment, typically ranging from 75% to 100%, upon maturity or death. This feature makes segregated funds an attractive option for investors looking to safeguard their capital while still participating in the potential growth of the market.

On the other hand, mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Unlike segregated funds, mutual funds do not offer principal protection, meaning that investors are exposed to the full volatility of the market.

When comparing segregated funds and mutual funds, it's essential to consider factors such as fees, liquidity, and estate planning implications. Segregated funds typically come with higher management fees compared to mutual funds, reflecting the added cost of insurance protection.

From an estate planning perspective, segregated funds offer several advantages, including bypassing probate and potential creditor protection benefits. By designating a beneficiary, investors can ensure that the proceeds from segregated funds are paid directly to their beneficiaries upon death, bypassing the lengthy and costly probate process. With segregated funds a beneficiary can be named for all contract types, including open and non-registered contracts. This is a big advantage vs mutual funds or even non-registered money at a chartered bank (ie – GIC’s, savings accounts, etc). Only insurance companies can offer the named beneficiary feature on all types of contracts. Furthermore, in certain provinces, segregated funds may offer protection from creditors in the event of bankruptcy or insolvency.

In conclusion, both segregated funds and mutual funds offer unique features and benefits to investors. Segregated funds provide principal protection and estate planning advantages, making them suitable for investors seeking capital preservation and peace of mind. On the other hand, mutual funds offer greater flexibility and transparency, allowing investors to tailor their investment portfolios to their specific goals and risk tolerance. Ultimately, the choice between segregated funds and mutual funds depends on individual preferences, financial objectives, and risk appetite. By understanding the differences between these investment options, investors can make informed decisions that align with their long-term financial goals.

Top of Form