Seg Funds vs Mutual Funds: A Comprehensive Guide for Business Owners in New Brunswick

If you're a business owner in New Brunswick looking to invest in the financial market, you may have come across the dilemma of choosing between Segregated Funds (Seg Funds) and Mutual Funds. Both investment options have their own set of features and benefits, but it's important to understand the differences to make an informed decision based on your financial goals and risk tolerance.

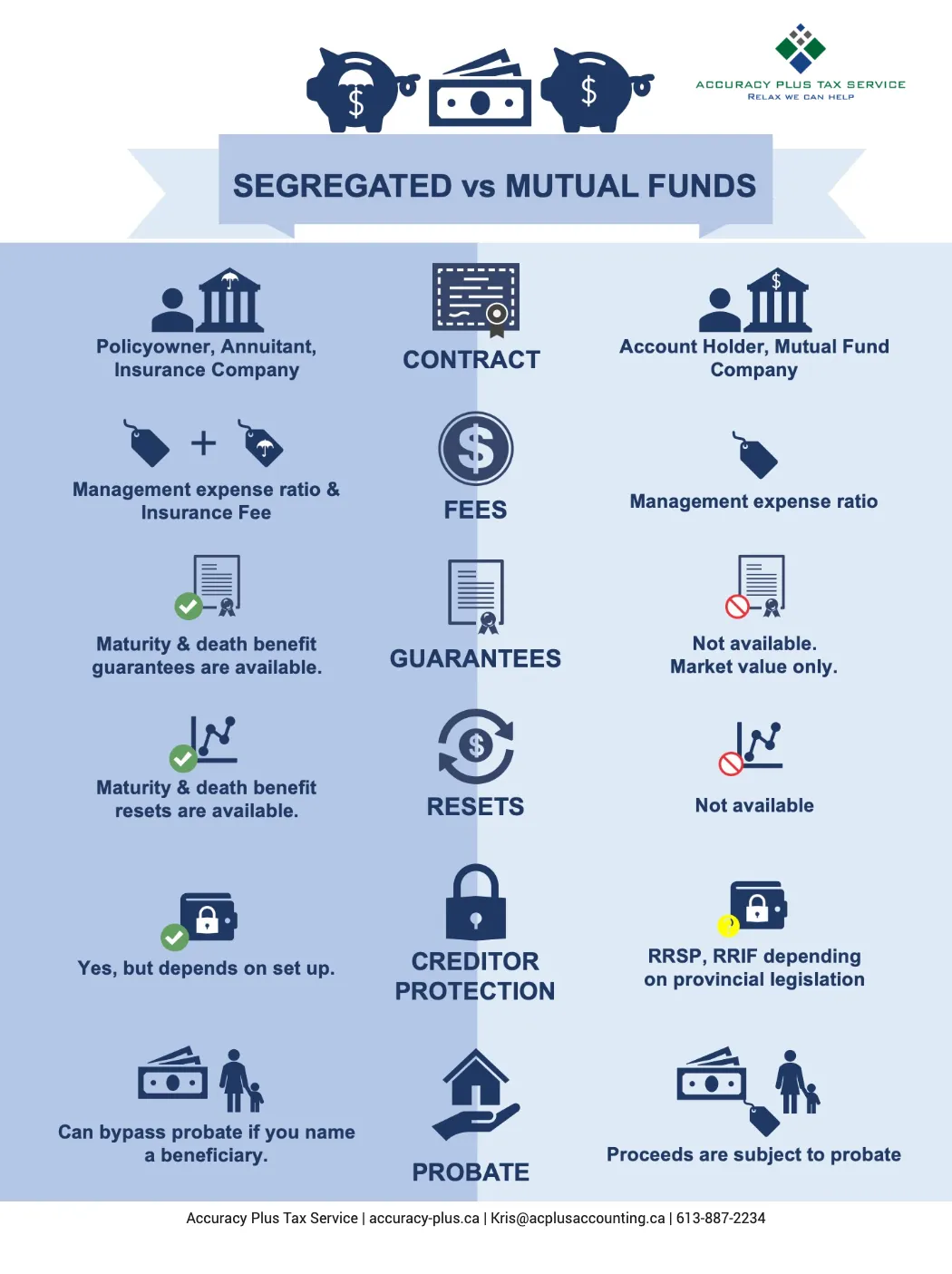

Segregated funds are unique in the sense that they are offered by life insurance companies and come with guarantees on the principal investment. Unlike mutual funds, Seg Funds guarantee all or most of the principal investment upon maturity or death, providing an extra layer of protection. This can be especially appealing for business owners looking to safeguard their investments against market volatility and potential insolvency.

Some key benefits of Segregated Funds include maturity or death benefit guarantees of 75% or 100%, protection from market volatility, automatic resets, estate planning advantages, and creditor protection. These features can provide peace of mind and security for business owners planning for their financial future.

On the other hand, Mutual Funds are more commonly known and involve pooling money with other investors to be managed by an investment firm. While Mutual Funds offer a variety of investment options and expert management by professional portfolio managers, they typically do not provide the same level of guarantees and benefits as Segregated Funds. Mutual Funds are subject to market volatility and may not offer maturity or death benefit guarantees, which can result in fluctuations in investment value.

Business owners in New Brunswick should carefully consider their investment goals, risk tolerance, and long-term financial planning when deciding between Segregated Funds and Mutual Funds. Seg Funds may be a better fit for those seeking additional protection and guarantees, while Mutual Funds may be suitable for investors comfortable with market fluctuations and seeking diversification.

In conclusion, Segregated Funds offer a unique set of benefits and protections that can be attractive to business owners in New Brunswick. However, it's important to consult with a financial advisor or licensed professional like Mike Plume of Plume Financial for personalized guidance tailored to your individual needs. By understanding the features and benefits of Seg Funds vs Mutual Funds, business owners can make informed decisions to secure their financial future.